Benefits of Using Foreign-Trade Zones (FTZs)

Leveraging Foreign-Trade Zones (FTZs) can boost efficiency in your customs procedures and international trade.

Here’s what you need to know.

What is a Foreign-Trade Zone (FTZ)?

Foreign-trade zones (FTZs) are designated areas within the United States where companies can import goods without paying duties or taxes until the goods are either consumed or sold domestically. This can provide significant savings for companies that import goods, as well as other benefits such as streamlined logistics and improved inventory control.

How do they work?

FTZs are operated by private companies or government agencies that have been approved by the U.S. Foreign-Trade Zones Board (FTZ Board). Companies that want to use an FTZ must first apply to the FTZ Board and be approved. Once approved, the company can then import goods into the FTZ and defer payment of duties and taxes until the goods are either consumed or sold domestically.

Benefits of Using a Foreign-Trade Zone:

Foreign-Trade Zones offer a variety of benefits, both to individual companies and the public as a whole. These benefits may vary among FTZs, but often include:

Companies that import goods into an FTZ can defer payment of duties and taxes until the goods are either consumed or sold domestically. Companies can defer or eliminate customs duties on imported goods, which can save them a significant amount of money, especially on expensive imports.

Goods destroyed within an FTZ are exempt from duties and quota charges on re-exports, so companies with fragile merchandise or processes that generate significant amounts of scrap can benefit from using an FTZ. When merchandise is manufactured or otherwise processed in the FTZ, the final product may be subject to a lower duty rate than it would have in its original condition. Labor, overhead and profit from FTZ production are also exempt from duty charges.

FTZs can help companies to improve their inventory control. For example, companies can use FTZs to consolidate inventory, stage goods for production, or test new products. This can help companies to reduce costs and improve efficiency.

Companies can reduce their merchandise processing fee (MPF) costs by using a Foreign-Trade Zone (FTZ). FTZ users can submit a single entry for all merchandise shipped from the Zone within a seven-day period, instead of submitting a single file for each individual shipment. This can help reduce costs by streamlining entry filings and reducing brokerage fees.

Companies can use Foreign-Trade Zones (FTZs) to import quota-restricted goods. If the quota for a particular item has been reached for the year, companies can store the goods in an FTZ until the new quota year begins. They can also alter or manipulate the goods in a way that changes the product category, making it no longer subject to the quota.

FTZs are often located near ports and airports, which can help businesses reduce their transportation costs. FTZs can also help companies streamline logistics operations. For example, companies can use FTZs to store goods temporarily, repackage goods, or perform minor manufacturing operations. This can help companies to save time and money on shipping and transportation costs.

Moreover, FTZs benefit the U.S. public in a variety of ways, including:

- Facilitating and expediting international trade: FTZs help to reduce the cost and time of importing and exporting goods, which makes it easier for businesses to trade internationally. This can lead to increased economic activity and job creation.

- Promoting and facilitating exports: FTZs offer a variety of benefits to exporters, such as deferred duty payments and duty-free manufacturing. This can help businesses to compete more effectively in the global marketplace.

- Helping U.S. businesses compete more effectively against foreign manufacturers: FTZs can help businesses to reduce their production costs, which can make them more competitive against foreign manufacturers.

- Encouraging retention of domestic businesses: FTZs can help to keep businesses from relocating overseas. This can help to protect jobs and boost the economy.

- Enhancing local and state economic development programs: FTZs can help to attract new businesses to a community and create new jobs. They can also help to boost the local economy by increasing tax revenue and stimulating economic activity.

Overall, FTZs are a valuable tool for promoting economic growth and job creation in the United States. They offer a variety of benefits to businesses and the public, and they can play a significant role in boosting the U.S. economy.

Types of Permitted Activities in FTZs:

- A zone might feature a variety of activities—from assembling and exhibiting merchandise to cleaning, manipulating, manufacturing, mixing or processing it. Relabeling and repackaging are also available as well as repairing items that need salvaging. Sampling goods for quality checking could be a part of the process too, along with storage options for safely stowing away products before they’re tested or displayed in-store. Finally, if necessary there is the option to destroy them when needed.

- All production activity must be approved by the FTZ Board before processing takes place. This includes activities with foreign items that significantly change their condition or alter its customs classification, which will determine if they are eligible for entry into a country’s consumption realm.

- Retail trade is prohibited in zones.

Other Activities:

Foreign-Trade Zones (FTZs) provide an efficient and cost-effective way to process goods distributed in the U.S., allowing companies to save time, energy, and money along the way! In fact, it’s so advantageous that FTZs are often used as a storage center for domestic shipments – even if those products will eventually be sent abroad since domestically-produced items cannot be bonded.

If you are a company that imports goods, you should consider using an FTZ. They can provide you with significant savings and other benefits that can help you to improve your bottom line, as well as offer operational efficiencies within your supply chain.

To learn more about FTZs and specific rules and regulations, explore our Crowley FTZ Guide or the website of the Foreign-Trade Zones Board at www.trade.gov.

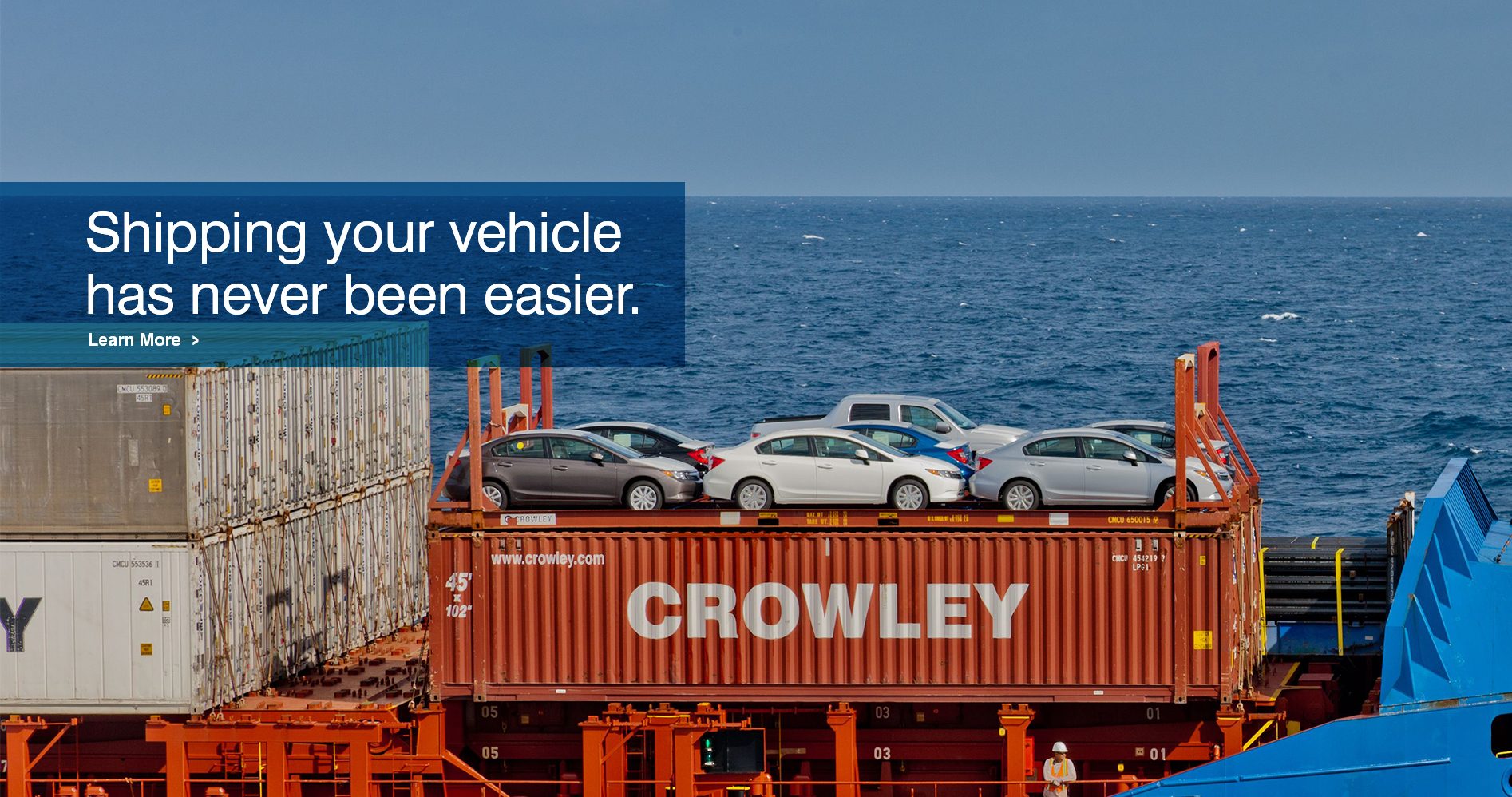

Interested in learning how Crowley can help you navigate FTZs?

Crowley is a leading provider of logistics and supply chain solutions. Our team of experienced professionals can help you to determine if an FTZ is right for your business.

Press Releases

Press Releases

Crowley Adds Newest LNG Ship to Fleet Expanding Caribbean and Central American Service

Crowley’s newest, LNG-powered containership Tiscapa began its inaugural service today, adding faster, bigger options for timely ocean cargo transport around the U.S., Caribbean and Central America. Like its sister ships in the Avance Class, Tiscapa features container capacity for 1,400 TEUs (20-foot equivalent units), including 300 refrigerated units. This ship was specifically designed to quickly and […]

Read More Blog

Blog

Puerto Rico Car Shipping FAQs: Your Top Questions Answered

We’re here to make your Puerto Rico car shipping smooth and stress-free. Whether it’s your first time or you’re a seasoned shipper, Crowley is here to answer the most common questions about shipping a car from Puerto Rico to the U.S. mainland. Need step-by-step instructions? Read our complete guide to shipping a car from Puerto Rico. Frequently Asked […]

Read More